Environmental, social, and governance (ESG) issues have become increasingly important to companies and investors in recent years. This is particularly true for companies in the real estate industry, which have a significant impact on the environment through their energy consumption and greenhouse gas (GHG) emissions. To mitigate these risks and improve their ESG practices, real estate companies can turn to technologies such as automated Fault Detection and Diagnostics (FDD) and Energy Management and Information Systems (EMIS).

According to research from the Urban Land Institute, the real estate industry is responsible for nearly 40% of global energy consumption and GHG emissions. In light of this, it is not surprising that governments around the world are implementing a variety of regulations and taxation schemes to incentivize companies to reduce their carbon footprints. These include cap and trade systems, carbon pricing, and renewable energy incentives.

The potential costs and risks associated with these regulatory and taxation changes for real estate companies can be significant. For example, a company with a large real estate portfolio may face significant costs if it is required to retrofit its buildings to meet new energy efficiency standards. A report from the Rocky Mountain Institute estimates that such retrofits could cost between $0.50 and $4.50 per square foot, depending on the specific measures implemented.

In addition to the regulatory risks, real estate companies also face financial risks from the increasing demand for ESG-conscious investing. A study by the Morgan Stanley Institute for Sustainable Investing found that companies with strong ESG performance tend to outperform their peers financially. In particular, the study found that companies with strong ESG ratings had a median return on investment of 12.2% compared to a median return of 8.9% for companies with weaker ESG ratings.

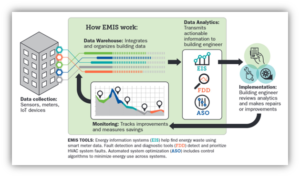

To mitigate these risks and improve their ESG practices, real estate companies can turn to technologies such as automated Fault Detection and Diagnostics (FDD), Energy Information Systems (EIS), and Automated System Optimization (ASO), tools typically included in a suite of products known as Energy Management and Information Systems (EMIS) These technologies can help companies optimize their energy consumption and reduce their GHG emissions, leading to cost savings and improved sustainability.

In addition to the financial benefits, implementing these technologies can also help real estate companies improve their sustainability and meet the growing demand for ESG-conscious investing. As regulatory and taxation schemes continue to evolve, it is likely that companies that prioritize sustainability will be better positioned to weather the changes and emerge as leaders in the industry.

Overall, the importance of ESG in the real estate industry cannot be overstated. Companies that own and operate their own real estate portfolios or provide facility management services for other companies face significant risks from regulatory and taxation changes related to GHG emissions and energy consumption.

To mitigate these risks and improve their sustainability, real estate companies should consider implementing technologies such as EMIS. By doing so, they can not only save money on energy costs and reduce their GHG emissions, but also better position themselves to meet the growing demand for ESG-conscious investing and potentially increase their share price.

References:

Urban Land Institute. (n.d.). The Global Real Estate Sustainability Benchmark.

Rocky Mountain Institute. (n.d.). Building Energy Retrofit Cost Study.

Morgan Stanley Institute for Sustainable Investing. (2019). The Business Case for ESG: A Review of the Literature. Lawrence Berkeley National Laboratory. (2020). Proving the Business Case for Building Analytics.